The Student Financial Services Department (formerly Bursar Department) oversees the billing and collection of student accounts.

The Student Financial Services Department strives to provide efficient, courteous and excellent customer service. We offer a variety of services, which are accessible online or in person. Some of our services include:

- Billing of Tuition and Fees

- Student Refunds

- Payment Plans

- Cashier Services

For more information, current students may access their ERNIE account to get detailed information and updates on tuition and fees, term start dates, 1098-T information, and collections.

Making Payments

The Worldwide Campus is pleased to offer a term payment plan with the following features:

- You can make up to three installments, depending on when you enroll

- An enrollment fee of $30 is required each term you enroll in the payment plan. This fee is included with your down payment when you enroll in the payment plan.

- Email notifications are sent each month including payment reminders or changes to your plan

- Plans become available 60 days prior to the start of each term

Payment Options

Tuition and fees are expected to be financially secured no later than seven days prior to the first day of the respective term. For those who register in the seven-day window, payment is expected at the time of registration. We offer a variety of payment options which include:

- Online payments through Campus Solutions:

- Electronic Check: Simple and no cost payment method. There are no fees to submit payment using this method. Please see How to Make a Student Payment.

- Credit Card (Credit card fees apply)

- Wire Transfer

- Money Order/Cashier Check

- Paper Check (U.S. funds)

- International and Domestic Wire Payments: Embry-Riddle Aeronautical University and Convera have partnered to provide an easy way for you to pay for your tuition. This assures that your funds will arrive on time and in full, without hidden charges. You pay in your home currency, either online or by bank transfer, and the school receives your payment in full and posts the payment to your student account quickly.

Benefits for you:

- Pay in your home currency. Don't see it available? Don't worry, you can still pay from your local bank account using USD.

- Pay from anywhere from your mobile, tablet or desktop device.

- Save on bank fees and exchange rates.

- Exchange rates locked in for 72 hours for international payments.

- Funds arrive at your institution quickly and in full.

- Track your payment every step of the way with status updates by text or email.

Embry-Riddle Aeronautical University does not accept overpayments on student accounts. Please transfer only the amount due on your student account to avoid payment delays.

Deferments

The university will grant deferments from the following sources:

Financial Aid: Upon receipt of your award notification and any requested documents, the Financial Aid Office will send you notification of award finalization and place a deferment on your account for the amount awarded.

Sponsorship: Any student whose tuition and fees are paid by a third party (Foreign Embassy, U.S. Government, Trust Account, sponsor, etc.) is considered a sponsored student. Formal arrangements for sponsor payments should be made with your campus advisor.

Veterans’ Education Benefits: This deferment is obtained by contacting your campus advisor.

Student account refunds will begin processing after the add/drop period for each term.

Electronic Refund (eRefund) is the quickest and most preferred way to get your Embry-Riddle refund. Click here for detailed instructions.

- eRefunds are processed daily. Enroll now!

- Printed check refunds will be sent to your home address.

Please note: Effective January 1, 2018, a student’s refund processed by paper check will only occur once a week. (Refunds processed electronically will continue to be processed daily).

Refunds

Financial aid that exceeds tuition and fees will be refunded within 7 – 10 business days after it has posted to your student account. All refund requests or questions should be directed to your campus or advisor. To expedite the refund process, it is recommended you sign up for direct deposit by enrolling in Electronic Refund (eRefunds).

Electronic Refund (eRefund) is the quickest and most preferred way to get your Embry-Riddle refund. Click here for detailed instructions.

Books and Supplies

Students who have excess financial aid after all tuition and fees are paid may be eligible to order books and supplies in the online bookstore. The excess financial aid funds are available 30 days prior to the start of the term. You may charge the cost of your books and supplies prior to financial aid being disbursed if you meet all the following criteria:

- You have completed all required documents on your "Task" Tile (To Do's)

- You have received your Financial Aid Award Notification

- You have accepted your Financial Aid Awards in your Campus Solutions Student Service Homepage

- If you accepted the Federal Direct Loans, you must have completed the application process (Federal Direct Loan process)

- You are registered in the required credit hours for the term that you need books and supplies

- Students must have financial aid in excess of their total tuition & fees

Order Requests for Books and Supplies: Eligible federal aid recipients inquiring about books and supplies should contact their campus or advisor for requests and/or questions.

Bookstore website: http://www.bkstr.com/erauworldwidestore/home

Please Note: If you become ineligible for financial aid, you will be financially responsible for all charges. If you fail to pay these charges, a financial hold will be placed on your account and Embry-Riddle may: (a) refer the debt to a collection agency for further collection efforts and pass on the cost of collection; (b) initiate legal proceedings against you; (c) withhold services such as transcripts, diploma and future registrations.

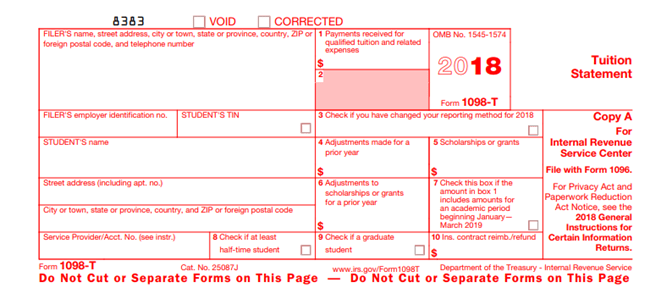

What is a 1098-T?

The 1098-T form reports the total amount of payments that Embry-Riddle received on your behalf for qualified tuition and related expenses over the course of the previous calendar year. The purpose of the 1098-T is to help you and/or your tax professional determine if you are eligible for the American Opportunity Credit or the Lifetime Learning Credit.

In order accurately report the IRS Form 1098-T, (which includes your enrollment and financial data to the IRS) the university must have:

- Your valid Social Security Number (SSN): While university policy does not require your SSN in the university's admissions process, IRS regulations require us to request your SSN. You may download IRS form W9S to provide your SSN. (Daytona Beach and Prescott students, please return this form to the appropriate Office of the Registrar).

Worldwide students can either fax their form to (386) 226-6984 or mail it to the address below:

Embry-Riddle Aeronautical University

Attn: Worldwide Imaging

1 Aerospace Boulevard

Daytona Beach, FL 32114

- A valid mailing address - In order to ensure timely and accurate reporting of your Form 1098-T each year, please keep all your addresses up to date with the university.

When can I expect my 1098-T?

If you are eligible to receive a 1098-T tax statement, it will be provided to you by January 31. This statement contains enrollment information and satisfies federal reporting requirements. A copy will be forwarded to the IRS.

* You may access your 1098-T online by logging onto ERNIE and navigating to the Finance Section of your Student Center. If you no longer have access to ERNIE or to view your 1098-T history, please access our third-party student loan servicer, ECSI. (You will need full name, SSN, and home zip code).

Can my parents retrieve my 1098-T?

As required by FERPA (Family Educational Rights & Privacy Act of 9.574), Embry-Riddle Aeronautical University or its personnel cannot release 1098-T information directly to parents, other persons who may claim the student as a dependent, or tax preparers.

If you are claimed as a dependent on another person's tax return (such as your parent's return), please give your Form 1098-T and Supplemental Information directly to that person.

How to read a 1098-T

The Service Provider/Acct. No. box in the lower left corner of the 1098-T form provides the Embry-Riddle student identification number.

** Due to recent changes in reporting requirements by the IRS, Embry-Riddle will report the total amounts of payment received on your behalf.

Box 1: Payments received for qualified tuition and related expenses. For further information, see the Instructions for Forms 1098-E and 1098-T.

Box 2: Amounts billed for qualified tuition and related expenses. This box will be left blank on all Embry-Riddle 1098-T forms.

Box 3: This box will not be checked.

Box 4: Adjustments made for a prior year. This box will be left blank on all Embry-Riddle 1098-T forms.

Box 5: Scholarships or grants. This box contains the sum of all scholarships, grants and third party payments processed for the student’s account during the calendar year.

Third party payments include, but are not limited to:

- military assistance

- veteran's benefits

- employee assistance programs

Box 6: Adjustments to scholarships or grants for a prior year

Decreases or refunds of scholarships, grants or third party payment amounts related to like payments reported in a previous year are included in this box. This amount is reported as a positive number per IRS requirements. However, it is actually a decrease to the amount that was reported on a prior year 1098-T.

Box 7: This box will be checked if the amount reported in Box 1 includes payments for qualified tuition and related expenses received in the reported year for a future semester which falls in the next calendar year. For example, payments received in December 2018 for Spring 2019 will be reported on a 2018 1098-T. Box 7 will be checked to indicate that this is the case.

Box 8: A check in this box indicates that you are or have been enrolled at Embry-Riddle at least half-time for at least one semester during the calendar year.

Box 9: This box will be checked if you are a student enrolled in a program leading to a graduate-level degree.

Box 10: This box is not used by Embry-Riddle, so it will be blank.

It is your responsibility to report third party payments on your tax return. If your tuition was paid in full by a third party sponsor including but not limited to;

- military assistance

- employee assistance programs

If you have any questions on whether you qualify for one of the tax relief opportunities, then you may need to consult a tax professional. Unfortunately, the university is prohibited from offering any tax advice. The student should not refer to the university for explanations relating to the eligibility requirements for, and/or calculation of, any allowable education tax credit or tuition and fees deduction. The final decision for determining eligible educational expenses is the student's responsibility. There are many sources of related information from the IRS that students may find helpful in determining eligibility and preparing their tax return. Below are IRS links that you may find helpful in preparing your taxes:

For further explanation or to determine if you are eligible to claim either of these tax credits, please contact your tax preparer or the IRS at 202-622-2970.

While we are not tax professionals and cannot provide tax advice, the resources below may provide helpful information you need. Please consult with a professional tax adviser for tax-related questions.

Contact Us

How Much Will It Cost?

Estimate your cost of attendance and amount of financial aid.